Pay stubs are generally a very significant form of records that are keeping document information. The whole company can benefit from accepting the pay stubs practice including the business owners and the team members. Logically, not every country or neither the state shares the same terms, rules, and regulations when it comes to the pay stubs.

Therefore, if your company is hiring globally people, you could face some administrative obstacles. In this article, we prepared a guide that will give you all the answers to the pay stub procedure and why it is important to get in the habit of looking at your pay stub.

Do a Company needs to Provide its Employees with Pay Stubs?

The answer to this question can be a little complicated since many factors are affecting it. In general, some jurisdictions really require business owners and other employers to provide their workers with pay stubs, while some jurisdictions do not have this rule. In case you are owning a company and you want to hire people internationally, you should gather information when it comes to the working law in your state or county.

This is very important since you can receive fines if you do not obtain your legal requirements. However, speaking generally, this is a very good action that your overall company can benefit from.

What does Pay Stub represent?

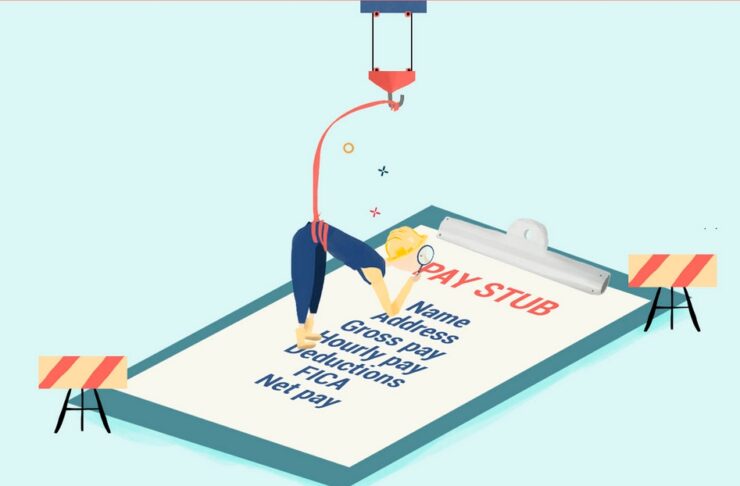

In order to understand the importance of a pay stub and how you can benefit from getting the habit of looking at your pay stub, it is necessary to primarily understand what this term represents. A pay stub is a document that includes all employees’ pay information. It is also known as a payslip, paycheck stub, or wage statement. A pay stub is itemizing workers’ wages that they earned for a particular pay period. Additionally, it shows all accumulated earnings and deductions for the tax year.

In a pay stub, you can find information such as hours worked, deductions, net pay, gross wages, and employer contributions that we are going to talk further about below in the text. For managing pay stubs for every pay cycle there is a special group of HR and payroll staff responsible. However, some companies are hiring a reliable third party for this job as well such as TheBestPaystubs which is a lot more effective and more efficient option.

What Are Pay Stubs Used For?

Paystubs are used in order to provide employees with an accurate record of their hours and wagers and this is exactly why you should start looking at your pay stub. This record is allowing tracking of every piece of information related to the pay and at the same time ensures the amount of money a person needs to receive.

One more reason why pay stubs are important is because they present the proof of income for loans. This means that banks and real estate agents will accept this document as evidence of your income and allow you to rent or even buy the property or apply for a loan. As you see tracking this record is very important for both your personal and professional life.

Why is it important to get in the habit of looking at your pay stub?

After the first couple of months after getting a new job, when the overall exciting pass, getting a pay stub becomes a routine that employees completely start to ignore. However, it is necessary for the employees to read their pay stubs every time when they get paid and now you are going to find why.

Problems with Taxes and Withholding

When you are owning a pay stub, you are getting accurate information from each pay and it is very important for you to ensure that you are checking them. Information such as names, pay rates, paid time off balance, social security number, etc is some of the details that need to be corrected. For instance, if the social security number is not correct, the taxes a worker filed with the federal and the state government will not be correct as well. Despite that, it can happen that withholdings are applied to someone else’s account.

The amount of Worked Hours

It is necessary for employees to check their worked hours and ensure that they are corrected. All hourly employees need to track their working hours and after that compare them with the information that is displayed on the pay stub record every pay period.

Getting a clear picture regarding Paid Time Off

One more thing why employees need to keep looking at their pay stubs is because they are obligated to track the time they take off throughout the whole year and make sure that those details are matching up with what is recorded on the pay stub.

The importance of Benefits Deductions

Employees should also be familiar with their benefits deductions which include their health, dental, and other benefits. More precisely, employees need to ensure that they are correctly calculated. If employees can not see these details on their pay stubs, they are not going to be able to obtain their earned benefits, and worst of all is that they can find out about this after they see a doctor and get a bill charging them for the medical treatment. Therefore, you need to pay attention to your pay stub records and ensure that they covered both you and your family.

Net Pay

Net pay refers to the take-home pay, that employees are deserving. More precisely, this refers to the amount of money they have earned and received in every pay check. Every person can easily and effectively calculate net pay by conducting the subtracting procedure. This means that they need to track all relevant taxes and deductions that come from the gross pay of every employee. In general, net pay present the money that one employer should transfer to an employee every pay period. Therefore, for getting relevant details towards net pay it is necessary to start looking at your pay stub record.